Gasoline prices are subject to a variety of factors that make them fluctuate. The primary determinant of retail gasoline prices is the cost of crude oil, which is influenced by global market dynamics including supply and demand. Other factors affecting gas prices include geopolitical tensions, seasonal demand variations, and the specifications for gasoline. The market for crude oil is complex, starting from production and extending to the refining process, which ultimately affects the price at the pump. Moreover, volatile gas prices can significantly impact the economy, with price swings influencing consumer spending and economic stability. Understanding these factors can provide insight into the current trends in gasoline pricing and why consumers may be experiencing higher costs at the gas station.

The Basics of Gas Pricing

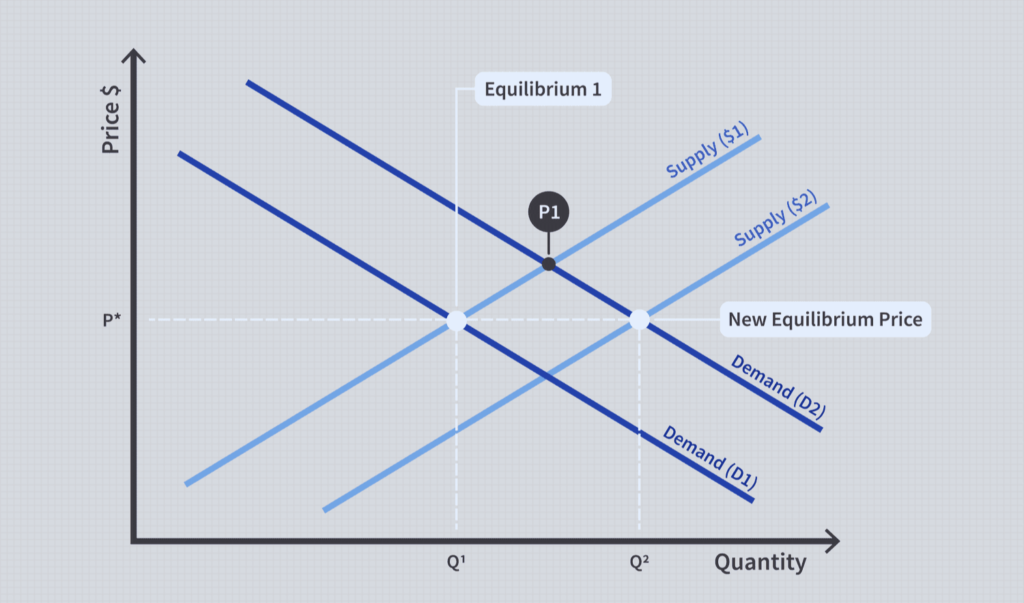

Supply and Demand

The fundamentals of gas pricing are deeply rooted in the principles of supply and demand. When demand for gasoline increases or when the supply of crude oil is limited, prices tend to rise. This is because buyers are willing to pay more to secure the necessary amount of fuel, and sellers can command higher prices when they know the product is in short supply. The price of crude oil is the primary determinant of gasoline prices, reflecting the cost of raw materials from which gasoline is produced. Seasonal variations, geopolitical tensions, and economic factors can also lead to fluctuations in supply and demand, thereby influencing gas prices. For example, colder weather can increase demand for heating fuels, putting upward pressure on natural gas and, consequently, gasoline prices. Understanding these dynamics is key to comprehending why gas prices fluctuate and sometimes spike.

Taxes and Regulations

Taxes and regulations significantly impact gasoline prices. Various taxes, including sales taxes, local, and municipal government taxes, directly influence the final price consumers pay for gasoline. These taxes can vary significantly by location, contributing to regional price differences. The structure of gas taxes, such as variable rate taxes, is designed to adjust with inflation, potentially increasing tax revenue as gas prices rise. This mechanism helps maintain the real value of tax revenue but can also lead to higher prices for consumers as inflation increases.

Policy solutions to mitigate the impact of rising gas prices include adjusting tax rates or implementing short-term tax holidays. However, these measures are often seen as temporary fixes rather than long-term solutions to the underlying issues of supply and demand affecting gas prices. Overall, the complex interplay between taxes, regulations, and market dynamics plays a crucial role in determining gas prices.

Crude Oil Prices

Crude oil prices are a fundamental factor in the determination of gas prices. For 2024 and 2025, the outlook for crude oil prices appears to be relatively stable, with expectations of flat or soft pricing due to a balance between supply and demand. The U.S. Energy Information Administration (EIA) forecasts that Brent crude oil prices will average around $82 per barrel in 2024 and $79 per barrel in 2025, closely aligning with the 2023 average. This stability is attributed to a surprisingly ample supply of oil, which is expected to keep prices soft in 2024. However, factors such as geopolitical uncertainty could potentially drive prices higher, with some predictions suggesting an average of $93 per barrel. Goldman Sachs has revised its forecast, expecting prices to range between $70 and $90 per barrel, indicating a degree of uncertainty and potential volatility in the market.

Current Factors Influencing Gas Prices

Geopolitical Tensions

Geopolitical tensions are a significant factor influencing global gas prices. In 2024, these tensions, particularly between Russia and NATO, alongside other concerns like cyberattacks and strategic competitions, have been identified as key geopolitical risks that could impact markets. Oil prices have seen fluctuations due to these tensions, with increases being capped by various factors, including economic growth forecasts and shifts in monetary policy. The potential for disruptions, such as those in Red Sea shipping, also adds a geopolitical premium to commodity prices, reflecting the broader market’s volatility. Despite strong output from non-OPEC producers and the United States, geopolitical risks could still lead to spikes in oil prices, further influencing gas prices at the consumer level. Overall, the current geopolitical landscape adds a layer of uncertainty to the commodity markets, directly affecting gas prices globally.

Natural Disasters

Natural disasters significantly impact gas prices primarily through their effects on supply and demand. When natural disasters occur, they can disrupt the production and distribution of gasoline, leading to reduced supply. This reduction in supply necessitates drawing from existing gasoline inventories or increasing imports to meet demand, often resulting in higher prices at the pump. Disasters can damage infrastructure, such as refineries and supply lines, causing a temporary shortage of fuel and thereby driving prices up due to increased demand against limited supply. Furthermore, the overall impact of extreme events, including natural disasters, on energy markets introduces additional price risk, as these events can unpredictably affect oil prices by increasing the uncertainty and perceived risk in energy markets.

Changes in Consumer Behavior

Pandemic Recovery

The pandemic has had a lasting impact on consumer behavior, leading to changes in spending patterns and contributing to the complexity of economic recovery. Consumers have become more cautious in their spending due to increased prices across various sectors, including food, gas, and housing. This caution reflects a strategic shift in shopping behaviors, with people making fewer purchases as prices rise.

In terms of gas prices, several factors contribute to their increase, not directly tied to pandemic recovery but influenced by the broader economic landscape. These include raw material prices affecting production and distribution costs, ongoing supply chain disruptions, and labor shortages. Furthermore, the rapid changes in global consumer patterns during the pandemic have had foundational impacts on the economy, affecting supply and demand across sectors, including the energy market.

Shifts to Remote

The shift to remote work has significantly influenced consumer behavior, leading to changes in spending patterns. With more people working from home, there’s been a noticeable shift in purchases from traditional office-related expenses like commuting and dining out to home office setups, including furniture and technology. This transition has also impacted spending on clothing, housing, and transportation, with remote workers adjusting their budgets to accommodate their new work environment.

Regarding gas prices, the rise in remote work could potentially reduce gasoline consumption as fewer people need to commute. This demand reduction might be expected to lower gas prices; however, various global economic factors, including supply chain disruptions and geopolitical tensions, often play a more significant role in determining fuel prices. Moreover, the rise of remote work has been identified as a potential long-term threat to oil demand, indicating that changes in work habits could have far-reaching effects on the energy sector.

Regional Variations in Gas Prices

Taxes and Infrastructure

Gasoline prices are influenced by a variety of factors, including regional variations due to differences in state and local taxes, as well as the cost of transportation and distribution infrastructure. These factors contribute to the fluctuating prices observed across different states and regions. Additionally, legislative actions can lead to changes in gas taxes, further affecting regional price differences. For instance, some states have enacted laws to increase gas and diesel fuel taxes, with adjustments indexed to annual changes in the Consumer Price Index (CPI), thereby potentially impacting gas prices over time.

Moreover, the overall outlook for gas prices in 2024 suggests that drivers may see lower motor fuel costs due to a jump in global refining capacity and a surplus in supply, despite the industry’s solid start to the year bolstered by high oil prices. This dynamic indicates that while infrastructure and taxes play significant roles in determining regional gas prices, global market conditions and supply chains also have a substantial impact on fuel costs.

Supply Chain Constraints

Gas prices are influenced by a multitude of factors, with supply chain constraints being a significant contributor. The balance of supply and demand is a primary driver of gas prices, where increases in supply generally lead to lower prices, and decreases in supply push prices higher. Disruptions in the supply chain, whether due to pandemic-related issues or other factors, have exacerbated price volatility by affecting both the supply of oil and gas and the operational capacity of refineries. Additionally, sudden disruptions in crude oil supplies, refinery operations, or gasoline pipeline deliveries can lead to rapid changes in gasoline prices.

Regional variations in gas prices can also arise from these supply chain disruptions, further compounded by local factors such as state and local taxes, transportation costs to different regions, and regional demand variances. Understanding the impact of these supply chain constraints on gas prices requires a comprehensive look at the global energy market and its vulnerabilities to fluctuations in supply and demand, as well as geopolitical and economic events.

The Future of Gas Prices

Renewable Energy Impact

Rising gas prices have underscored the urgency and economic viability of transitioning to renewable energy sources. Renewable energy, such as wind and solar, offers a pathway to reducing greenhouse gas emissions and is becoming increasingly cost-competitive with traditional fossil fuels, including coal, oil, and natural gas. The high prices of gas have been attributed to several factors, including supply chain constraints, geopolitical tensions, and fluctuating demand, which have led to calls from renewable energy advocates for a faster shift towards renewables. The economic landscape is such that high gas prices are making renewable energy more competitive, even without tax credits, as renewables continue to decrease in cost over time. This shift is crucial for not only addressing the immediate impacts of high energy prices but also for ensuring a sustainable and economically resilient energy future.

Technological Advancements

Technological advancements significantly influence natural gas pricing and the broader energy market. Over recent years, innovations have led to more efficient extraction and production methods, impacting natural gas pricing by potentially lowering production costs. For instance, improvements in drilling technologies have enabled producers to explore new and more costly sources of crude oil more economically. Moreover, technology plays a critical role in optimizing operations and mitigating the impact of rising fuel costs, through advancements such as digitalization in the oil and gas sector, which drives down costs.

However, external factors, such as geopolitical tensions and wars, can rapidly alter oil prices, influencing gas prices as a consequence. For example, recent conflicts have raised concerns about potential increases in oil prices, which would directly affect gas prices. These dynamics underscore the complex interplay between technological advancements and external factors in determining gas prices’ future trajectory.

How to Mitigate Rising Gas Prices

Efficient Driving Habits

To mitigate rising gas prices, adopting efficient driving habits is crucial. Key strategies include:

- Setting Speed Restrictions: Driving at optimal speeds can significantly improve fuel efficiency, saving costs.

- Improving Vehicle Fuel Economy: Small changes, like proper vehicle maintenance and efficient route planning, can reduce fuel consumption on a larger scale.

- Adopting a Multi-Prong Strategy: This involves downsizing to smaller, more fuel-efficient vehicles and integrating fuel-saving technologies.

- Utilizing Cruise Control: Helps in maintaining a constant speed, reducing fuel consumption.

- Strengthening Vehicle Efficiency Standards: A long-term solution that involves regulating the average fuel economy of vehicles.

- Avoiding Rapid Acceleration and Hard Braking: These actions significantly increase fuel usage. Also, avoid extended idling to warm up the engine.

Alternative Transportation

To mitigate rising gas prices, focusing on alternative transportation and fuel-efficient practices is essential. Strategies include:

- Embracing Sustainable Transportation: Aiming for cost-effectiveness in the long run, reducing reliance on fossil fuels, and mitigating environmental impacts. This includes exploring options like electric vehicles, public transit, cycling, and walking.

- Adopting Fuel-Efficient Practices: As gas prices rise, the importance of fuel efficiency and alternative transportation options becomes more pronounced. This includes driving habits that conserve fuel and the use of vehicles with higher fuel economy.

- Electrification and Compact Planning: Reducing both private and public transport costs through the adoption of electrified transport systems and more compact city planning to minimize travel distances.

- Route Optimization and Load Consolidation: Implementing smart logistics strategies such as optimizing routes to decrease empty miles and consolidating loads to reduce the number of trips, thereby saving on fuel costs.

- Exploring Alternative Fuels: Despite the higher initial costs, investing in alternative fuels and technologies can lead to long-term savings and reduced dependency on traditional fossil fuels.

Conclusion

In the swirling vortex of factors affecting gas prices, it’s clear there’s no single villain. It’s a complex interplay of global events, natural disasters, and our behaviors. While we might not control the global oil market, understanding these factors can help us make smarter decisions and maybe, just maybe, take some of the sting out of those trips to the gas station.

Read also: Who is Tom Brady Dating?

FAQs

Q. What’s the biggest factor in gas price changes?

Crude oil prices are usually the heavyweight champ in influencing gas prices, swinging up and down with global market changes.

Q. Can we expect gas prices to stabilize soon?

Predicting gas prices is like forecasting the weather. There are so many variables that it’s tough to say, but keeping an eye on global events can give us some clues.

Q. How does renewable energy affect gas prices?

Renewable energy offers alternative sources of power, which, in the long run, could lessen our reliance on gas and potentially stabilize or lower prices.

Q. Why do gas prices vary so much from state to state?

Taxes, environmental regulations, and the cost of transporting gas to different areas all play a part in the regional price differences.

Q. Is there a best time of year to buy gas?

Historically, gas prices tend to be lower in the winter and higher in the summer due to demand and the summer blend gas, which is more expensive to produce.