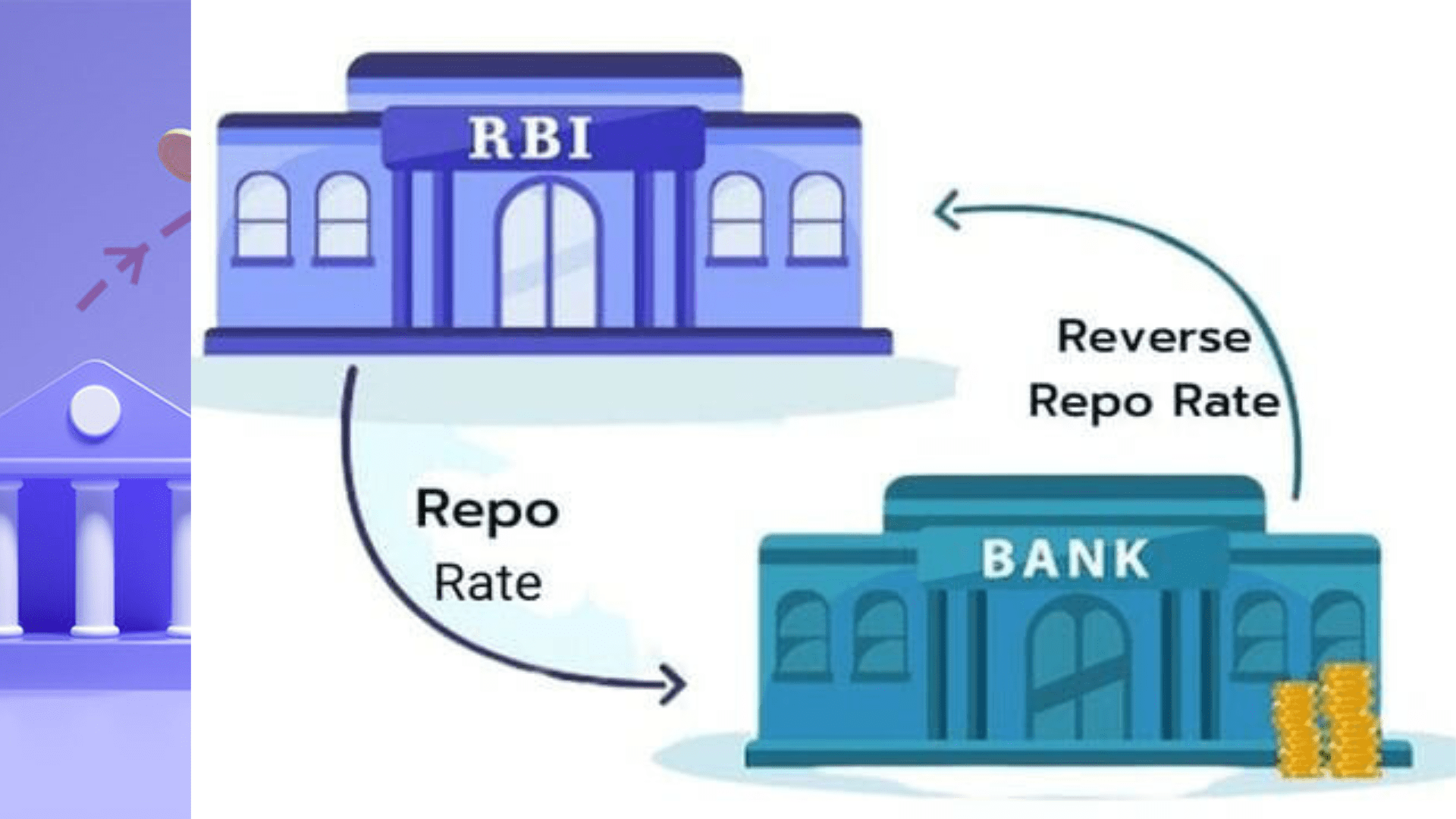

The Repo Rate is the interest rate at which the central bank of a country lends money to commercial banks in the event of any shortfall of funds. It is used by monetary authorities to control inflation. The Reverse Repo Rate, on the other hand, is the rate at which the central bank borrows money from commercial banks within the country. It is a monetary policy tool used to control the money supply in the economy. Essentially, Repo and Reverse Repo rates are mechanisms through which central banks influence liquidity and inflation, thereby impacting the overall economic activity. Repos and reverse repos are essentially two sides of the same transaction, reflecting the role of each party involved in the process. The Reverse Repo Rate serves as a tool for the central bank to absorb liquidity from the banking system, whereas the Repo Rate injects liquidity into the system.

Introduction to Repo Rate

The Repo Rate is a crucial financial term, representing the interest rate at which a country’s central bank (e.g., the Reserve Bank of India for India) lends money to commercial banks. This mechanism is used by central banks to control inflation and regulate the supply of money in the economy. When the central bank increases the repo rate, borrowing costs for banks rise, leading to higher loan rates for consumers and businesses, which can slow economic activity and reduce inflation. Conversely, lowering the repo rate makes borrowing cheaper, potentially stimulating economic growth. A repurchase agreement or repo involves the sale of government securities by dealers, with a promise to buy them back at a future date at a predetermined price, the interest cost associated with these transactions is known as the repo rate. The repo market plays a vital role in the financial system, providing liquidity and facilitating the flow of money between financial institutions.

The Mechanics of Repo Rate

The Repo Rate, often seen as a tool for monetary policy, is the rate at which the central bank of a country (such as the Reserve Bank of India or the Federal Reserve in the United States) lends money to commercial banks in the event of any shortfall of funds. This mechanism is used to control inflation and stabilize the currency by influencing the level of economic activity through the cost of borrowing. The process involves the sale of government securities by banks to the central bank with an agreement to repurchase them at a future date at a predetermined price. The difference between the sale and repurchase price determines the cost of borrowing for banks, which directly impacts the interest rates they charge their customers. Repo rates can fluctuate based on economic conditions, and adjustments are made to either encourage spending (by lowering the rate) or to cool down an overheating economy (by raising the rate).

How Repo Rate Affects You and the Economy

The Repo Rate is a crucial tool used by central banks to control liquidity, inflation, and economic activity. When the central bank increases the Repo Rate, borrowing costs for banks rise. Consequently, this increase is often passed on to consumers in the form of higher interest rates on loans, making borrowing more expensive. This can lead to reduced spending and investment, helping to cool down inflation but potentially slowing down economic growth. Conversely, a decrease in the Repo Rate lowers borrowing costs, making credit more affordable. This encourages spending and investment, boosting economic activity but possibly leading to higher inflation if the money supply increases too much. The Repo Rate’s impact on the economy is significant, affecting everything from personal finances to the overall supply of money and the pace of economic growth.

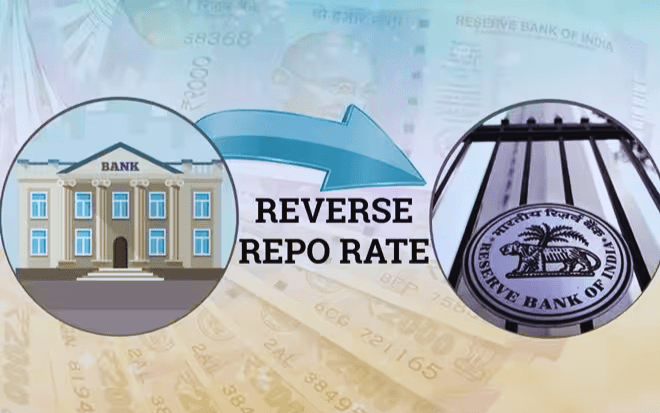

Introduction to Reverse Repo Rate

The Reverse Repo Rate is the rate at which the central bank of a country (e.g., the Reserve Bank of India or the Federal Reserve in the United States) borrows money from commercial banks within the country. It is a monetary policy instrument used to control the money supply in the economy. By adjusting the reverse repo rate, the central bank can influence banks’ willingness to lend money to the central bank, thus affecting the liquidity and overall money supply in the country. When the central bank wants to reduce liquidity in the banking system, it increases the reverse repo rate, making it more attractive for banks to deposit their funds, thereby withdrawing money from circulation. Conversely, lowering the reverse repo rate discourages banks from keeping their funds with the central bank, increasing the amount of money available for lending to the public and businesses.

The Mechanics of Reverse Repo Rate

The Reverse Repo Rate is a critical monetary policy tool used by central banks to manage liquidity in the banking system. It refers to the rate at which the central bank borrows money from commercial banks for a short period. Here’s how it works:

- Objective: The primary goal is to control the money supply within the economy. By adjusting the reverse repo rate, the central bank influences the level of excess liquidity in the banking system.

- Operation: In a reverse repurchase agreement, the central bank purchases securities from commercial banks with an agreement to sell them back at a future date. This operation effectively withdraws money from the banking system, as banks transfer funds to the central bank in exchange for securities, thereby reducing the money available for lending to the public.

- Effect on Money Supply: Increasing the reverse repo rate makes it more attractive for banks to park their funds with the central bank, leading to a decrease in the money supply. Conversely, lowering the rate discourages banks from depositing funds, increasing the money supply available for loans and advances.

- Economic Impact: By manipulating the reverse repo rate, the central bank can target inflation, stimulate economic growth, or stabilize the financial system, depending on the current economic conditions.

How Reverse Repo Rate Affects You and the Economy

The Reverse Repo Rate is a monetary policy tool used by central banks to control the money supply in the economy. Its adjustment has both direct and indirect effects on consumers and the broader economic environment:

- Liquidity Management: An increase in the reverse repo rate can decrease the money supply by encouraging banks to park more funds with the central bank, thus reducing liquidity in the market. Conversely, a decrease in the rate increases liquidity by making it less attractive for banks to hold funds with the central bank.

- Inflation Control: By adjusting the reverse repo rate to absorb excess liquidity, central banks can curb inflationary pressures. A higher rate can help cool down an overheating economy by making borrowing more expensive for banks, thereby reducing spending and investment.

- Impact on Borrowing Costs: Changes in the reverse repo rate can influence the interest rates that banks offer on loans and deposits. An increase in the rate can lead to higher borrowing costs, making loans more expensive for consumers and businesses. This can reduce consumer spending and investment by businesses, impacting economic growth.

- Exchange Rate Effects: The reverse repo rate can also impact the exchange rate of the national currency. By influencing the flow of foreign capital, changes in the rate can lead to fluctuations in the value of the currency, affecting imports, exports, and foreign debt.

The Dance Between Repo Rate and Reverse Repo Rate

The repo rate and reverse repo rate are crucial monetary tools used by central banks to manage liquidity in the banking system, affecting overall economic stability. The repo rate is the rate at which the central bank lends money to commercial banks, often to meet short-term funding needs. Conversely, the reverse repo rate is the rate at which the central bank borrows money from commercial banks, helping to control the money supply in the economy.

- Direction of Transaction: The primary difference lies in the direction of the transaction. The repo rate involves lending, with the central bank providing funds to commercial banks. The reverse repo rate, however, involves borrowing, with the central bank absorbing excess liquidity from commercial banks.

- Impact on the Economy: Changes in these rates can influence inflation, economic growth, and currency value. A higher repo rate makes borrowing more expensive for banks, potentially slowing down investment and spending. A higher reverse repo rate, in contrast, encourages banks to park more funds with the central bank, reducing liquidity in the market.

- Interest Rate Correlation: Typically, the repo rate is set higher than the reverse repo rate. This differential encourages banks to lend to each other to meet short-term fund requirements instead of parking excess funds with the central bank, thereby maintaining liquidity in the financial system.

Repo Rate vs. Reverse Repo Rate: Understanding the Differences

The Repo Rate and Reverse Repo Rate are critical monetary policy tools used by central banks to control liquidity and inflation within an economy.

- Repo Rate is the rate at which the central bank lends money to commercial banks. This rate is used as a tool to control inflation. When the repo rate increases, borrowing from the central bank becomes more expensive, leading to reduced money supply in the economy, and vice versa.

- Reverse Repo Rate is the rate at which the central bank borrows money from commercial banks. This tool is used to control the money supply by providing an incentive for banks to deposit their excess funds with the central bank, earning a certain interest. When the reverse repo rate increases, banks are encouraged to park more money with the central bank, reducing liquidity in the market.

The primary difference lies in their purpose and direction of the flow of money. While the repo rate aims to regulate inflation and encourage economic activity by controlling the cost of borrowing, the reverse repo rate helps in absorbing excess liquidity from the banking system, thereby preventing the economy from overheating.

The Impact of Changing Rates on the Market

The Repo Rate is the rate at which the central bank of a country (e.g., the Reserve Bank of India or RBI) lends money to commercial banks in the event of any shortfall of funds. It is used by monetary authorities to control inflation. When the repo rate increases, borrowing from the central bank becomes costlier for banks, leading to higher loan interest rates for consumers and businesses, which can slow down economic activity and help control inflation.

The Reverse Repo Rate, on the other hand, is the rate at which the central bank borrows money from commercial banks. An increase in the reverse repo rate means that the banks will get a higher interest on their excess funds deposited with the central bank, encouraging them to deposit more rather than lending it out. This can reduce the money supply in the economy, helping to control inflation.

In summary, adjusting the repo and reverse repo rates is a key tool for central banks to manage the economy’s money supply, inflation, and overall economic activity. Decreasing repo rates makes borrowing cheaper, potentially stimulating spending and investment, whereas increasing them can have the opposite effect, slowing down the economy.

Why Central Banks Adjust These Rates

Central banks adjust interest rates to manage economic stability, control inflation and influence the overall level of economic activity. When central banks lower interest rates, it becomes cheaper for banks to borrow money, which in turn can make lending more attractive to consumers and businesses. This can stimulate spending, investment, and economic growth.

Conversely, central banks raise interest rates to cool down an overheating economy and curb inflation. Higher interest rates make borrowing more expensive, which can reduce spending and borrowing by consumers and businesses. This is intended to slow down economic growth and reduce inflationary pressure.

In summary, central banks adjust interest rates as a primary tool of monetary policy to maintain economic stability, achieve low and stable inflation, and promote sustainable growth.

The Global Perspective on Repo and Reverse Repo Rates

The global repo and reverse repo markets have seen significant activity, reflecting changes in liquidity, interest rates, and monetary policy adjustments by central banks. In October 2023, substantial increases in reverse repo volumes were noted, especially in Spanish, Dutch, and Irish government bonds, indicating a heightened demand for secure, short-term investment options. The Federal Reserve’s Overnight Reverse Repurchase Agreement (ON RRP) facility serves as a tool to provide a floor under overnight interest rates, accommodating a wide range of financial institutions. This facility saw a surge in inflows, hitting $1.018 trillion by the end of December 2023, as the Fed aimed to reduce liquidity in the market. The adjustments in repo and reverse repo rates globally are strategic moves by central banks to manage liquidity, influence short-term interest rates, and maintain economic stability.

Case Studies: Repo and Reverse Repo Rates Around the World

Repo and reverse repo activities serve as critical mechanisms in the global financial system, facilitating liquidity and serving as indicators of financial health and policy effectiveness. The repo market updates from December 2023 showed a slight decrease in reverse repo activity by -0.44% but an increase in the average term to 135.81 days, indicating a shift toward longer-duration agreements. In contrast, October 2023 saw significant increases in reverse repo volumes, especially with government bonds from Spain, the Netherlands, and Ireland, reflecting diverse market conditions across Europe.

The IMF provides an educational breakdown of repurchase agreements, distinguishing between repo (spot sale with a forward purchase) and reverse repo (spot purchase and forward sale), which underscores the contractual foundation of these instruments and their significance in financial analysis. Furthermore, case studies on central bank crisis interventions highlighted the role of reverse repos among various tools used to manage liquidity and stabilize markets during times of stress.

This global perspective underlines the complexity and importance of repo and reverse repo markets in maintaining financial stability and providing mechanisms for managing liquidity across different economies.

The Role of Repo and Reverse Repo Rates in Financial Crises

Repo and reverse repo rates play critical roles in financial markets, especially during crises. The repo market is a primary source of short-term borrowing for financial institutions, utilizing securities as collateral. This market is crucial for liquidity management and the smooth functioning of financial markets. During a financial crisis, the demand for repo borrowing can spike as institutions seek liquidity, which can lead to increased repo rates, signaling stress in the financial system. Conversely, reverse repos are used by central banks to withdraw liquidity from the banking system, which can stabilize money market rates.

The 2007-2008 financial crisis highlighted the repo market’s vulnerability, where a run on the repo market contributed significantly to the crisis. The panic ensued from fears over the quality of collateral, leading to a sudden withdrawal of repo lending. The Fed’s intervention in the repo market, including reverse repo agreements, is a mechanism to manage such crises by injecting or withdrawing liquidity to control interest rates and stabilize the financial system.

How to Keep Up with Repo and Reverse Repo Rate Changes

To stay informed about changes in repo and reverse repo rates, consider the following strategies:

- Monitor Central Bank Websites: Central banks, like the Federal Reserve, regularly update their repo and reverse repo operations on their websites. These updates include detailed information about daily operations, policy changes, and historical data.

- Follow Financial News: Financial news websites and Economic Times publications provide analyses and updates on repo rates and their implications on the market. They often include expert commentary that can help interpret the changes.

- Use Financial Education Resources: Websites like Investopedia offer detailed explanations on the mechanics of repo and reverse repo agreements and their role in the financial system. These resources can be valuable for understanding the broader implications of rate changes.

- Follow Academic and Research Institutions: Research notes and articles from federal reserves or academic institutions provide in-depth analysis and findings on the impact of repo rates on the money market and financial stability.

By combining these sources, you can gain a comprehensive understanding of repo and reverse repo rate changes and their impact on the financial markets.

Tools and Resources for Monitoring

To effectively monitor repo and reverse repo rates, consider utilizing the following tools and resources:

- Federal Reserve Website: The Fed’s official site provides comprehensive information on monetary policy tools, including reverse repos, to manage money market rates. It’s a primary source for understanding how these tools influence short-term rates.

- SIFMA Research: Offers detailed US repo market statistics, tracking volumes and transactions, which can be valuable for understanding market trends.

- DTCC GCF Repo Index: Provides a unique index tracking the average daily interest rate of highly traded GCF Repo contracts, offering insights into the repo market’s current state.

- New York Fed Operations: For daily updates on repo and reverse repo operations, including the federal funds rate target range, the New York Fed’s website is an essential resource.

- Market News: Reuters and other financial news outlets regularly report on changes to the Fed’s reverse repo facility and its impact on the market, providing timely updates and analyses.

By leveraging these resources, individuals and professionals can stay informed about the latest developments in repo and reverse repo rates.

Conclusion

Understanding the repo and reverse repo rates is like having a key to the engine room of the economy. They influence how much it costs to borrow money, the returns on savings, and overall economic health. By keeping an eye on these rates, you can better navigate the financial waves.

Read also: What is a Floor Test?

FAQs

Q. What causes central banks to change the repo rate?

Central banks adjust the repo rate based on their economic outlook, aiming to control inflation and stimulate growth as needed.

Q. Can the reverse repo rate be higher than the repo rate?

Typically, the reverse repo rate is lower than the repo rate, but economic circumstances can lead to unusual rate structures.

Q. How often do these rates change?

The frequency of change varies by country and economic conditions. Some central banks review rates monthly, quarterly, or as needed.

Q. Do repo and reverse repo rates affect stock markets?

Yes, changes in these rates can influence investor sentiment and stock market trends, impacting everything from individual stocks to the overall market.

Q. How can an individual keep track of these rates?

Individuals can follow central bank announcements, and financial news websites, and use financial analysis apps to stay updated on rate changes and their implications.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?