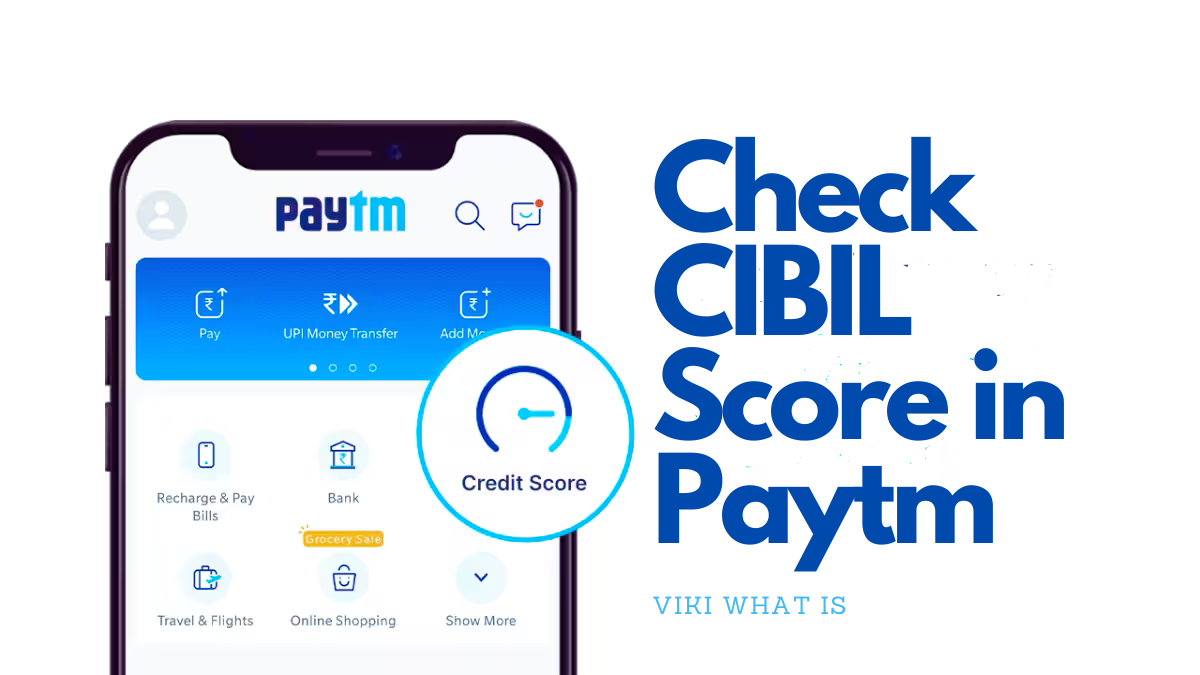

In today’s fast-paced digital world, financial stability is crucial. One of the key elements that financial institutions consider before approving loans or credit cards is your Credit Information Bureau India Limited (CIBIL) score. Your CIBIL score is a numeric representation of your creditworthiness and financial discipline. If you’re wondering how to check your CIBIL score conveniently using Paytm, you’re in the right place. In this guide, we’ll walk you through the simple steps to check your CIBIL score hassle-free.

Understanding the Importance of CIBIL Score

Before diving into the process, it’s essential to understand why your CIBIL score matters. Your CIBIL score, ranging from 300 to 900, reflects your credit history, outstanding debts, and repayment patterns. A high CIBIL score indicates financial responsibility, making it easier to secure loans or credit cards with favorable terms.

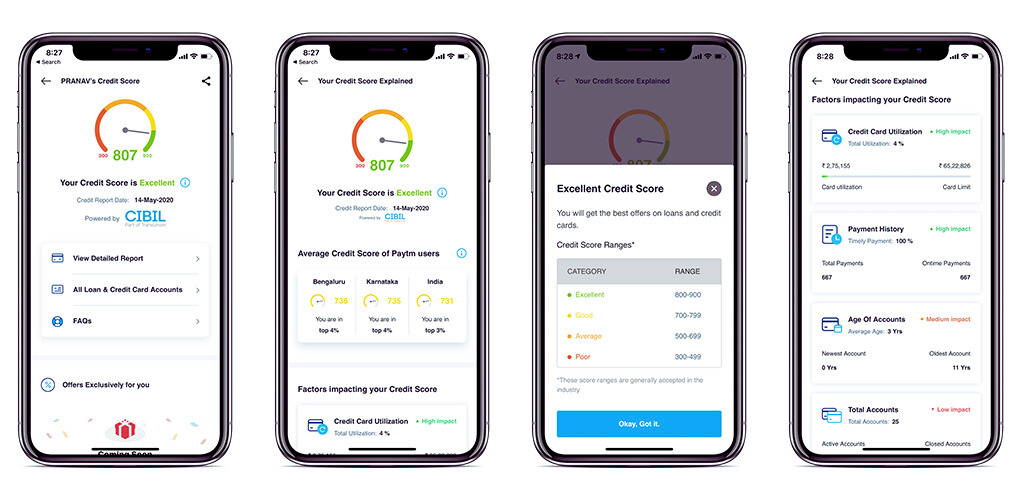

Step-by-Step Guide to Check Your CIBIL Score in Paytm

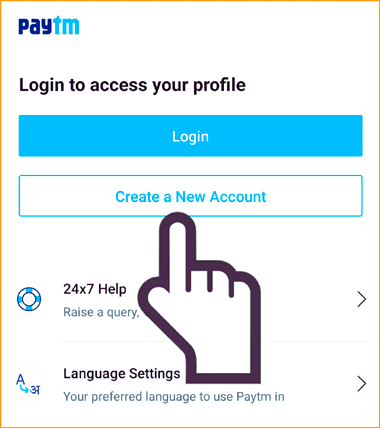

1. Log In to Your Paytm Account:

Start by opening the Paytm app on your smartphone. Log in to your account using your credentials.

2. Navigate to the Credit Score Section:

Within the Paytm app, locate the ‘Credit Score’ section. Usually, it can be found under the ‘Profile’ or ‘My Account’ tab.

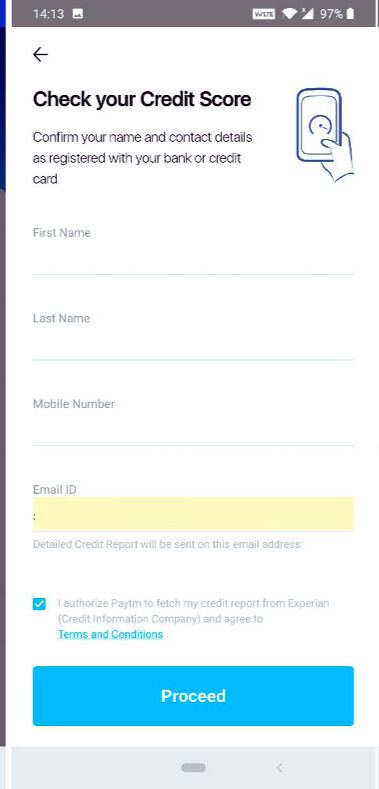

3. Verify Your Identity:

To access your CIBIL score, Paytm may require you to verify your identity. Provide the necessary details as prompted to proceed.

4. View Your CIBIL Score:

Once your identity is verified, your CIBIL score will be displayed on the screen. Take note of the score and the factors affecting it.

5. Understand Your CIBIL Report:

Paytm often provides a detailed credit report along with your score. Take your time to review the report, and understand your financial behavior and credit history.

6. Explore Financial Products:

Based on your CIBIL score, Paytm might suggest suitable financial products like loans or credit cards tailored to your profile. Evaluate these options carefully.

Why Checking Your CIBIL Score on Paytm Is Beneficial

Checking your CIBIL score on Paytm offers several advantages:

- Convenience: Paytm’s user-friendly interface makes it incredibly easy to check your CIBIL score within a few taps.

- Timely Alerts: Paytm may offer features like score updates and alerts for any significant changes in your credit profile, helping you stay informed.

- Financial Planning: Understanding your CIBIL score empowers you to make informed financial decisions, improving your creditworthiness over time.

Conclusion

In conclusion, monitoring your CIBIL score regularly is a proactive step towards maintaining healthy financial habits. Paytm’s seamless process ensures you can access this vital information anytime, anywhere. By staying updated on your CIBIL score, you are better prepared to achieve your financial goals and make sound financial decisions.

Read also: When Do the Clocks Go Forward: Embracing the Time Change

Your CIBIL score is crucial as it reflects your creditworthiness, impacting your ability to secure loans or credit cards with favorable terms. Financial institutions use it to assess your repayment behavior and financial discipline.

A CIBIL score above 750 is generally considered good, indicating a strong credit profile and increasing your chances of loan approval at competitive interest rates.

It’s advisable to check your CIBIL score at least once a year. Regular monitoring helps you identify errors, fraud, or discrepancies, allowing you to rectify them promptly.

To improve your CIBIL score, ensure timely repayment of loans and credit card bills, maintain a balanced credit utilization ratio, and avoid multiple loan applications within a short period.